Online banking has become quite an important tool for every customer of a bank, especially these days when everything is going digital, right? Though, what if a bank can go beyond that and provide a platform tailored for business owners? A portal crafted to manage payment collections, share payout schedules, and view monthly analyses of finances. This is precisely what the Tallyman Axis portal is designed for. If you are still short on Tallyman of Axis Bank information, just hang in there, we can expand on that in a few.

Now, let us define what the Tallyman Axis is. It is actually a collaborative effort between Axis Bank and Experian, aimed at making it easier for small and medium-sized enterprises to manage their cash flows. Just so you know, this platform removes the troubles of debit cards and credit cards or navigating the Internet banking channel in favor of an easy way to manage payments, schedule payouts, and receive the monthly financial picture as a whole. Today though, we’ll be going over how you can register for it, how you can log in, and why you should be using it in the first place.

Tallyman Axis Registration Process

Thinking about setting up a Tallyman Axis account? You won’t have to worry about any things that you do not understand. All that you need to do is some of the following steps. First, if you are near wherever the nearest Axis Bank is situated or if you are abroad you can just call the manager of the bank instead. When you go there, you must make sure to tell them some basic information about what your business is doing along with what you are trying to achieve using the Tallyman Axis Collection service. Straight away, the bank may require more information about your business, so be ready to provide the necessary data. After everything has been cleared, all you need to do is wait for the total processing time of up to two weeks, and upon completion, your login credentials will be delivered to you, which means you can start working. That’s all. There is no online signup process or anything like that, it is done using only by contacting the Axis Bank.

Tallyman Axis Login Process

The process of logging into the Tallyman Axis portal is pretty simple once you’ve signed up for it. Like the super easy steps given below, let’s go through the process quickly:

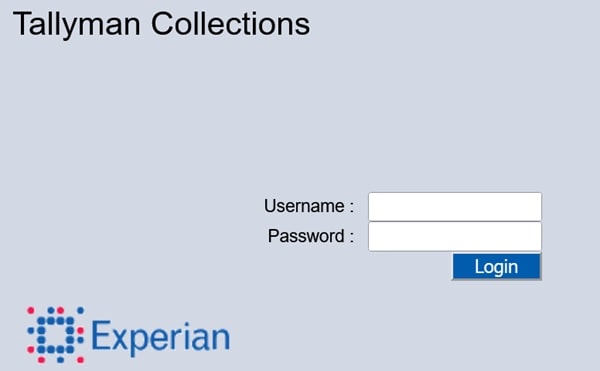

- Visit the Tallyman Axis Login Page: First, open the Tallyman Axis portal URL https://collections.axisbank.co.in/collections/ViewLogin.do in your web browser.

- Enter Your Login Details: On this page, submit your Tallyman username and password in the provided fields.

- Double-Check Your Information: Confirm at this stage that you have successfully inserted all the items in the fields correctly, and then click on the “Log in” button.

- Complete Any Security Steps (if needed): Depending on your security settings, you may need to verify your identity through two-factor authentication, such as an OTP which is actually sent to your phone or email after your first login.

- Log In and Access Your Dashboard: And at last, after logging you will reach your personalized dashboard via which you get to manage your finances and access several services. Simple as that.

Services And Benefits Offered by Tallyman Axis

Tallyman Axis does not only offer basic banking services, rather, it incorporates a bunch of very specific financial tools that are guaranteed to simplify account management and also help improve efficiencies in operations. Below are a few of these services or benefits which will be more than enough for you to decide why you should be using Tallyman Axis in the first place. Here we go:

- Comprehensive Account Management: Account management via Tallyman Axis is made easier because you can do everything from checking account balances to viewing transaction histories, transferring funds, and paying bills from a single easy-to-use platform.

- Instant Alerts for Every Transaction: You can never be more up-to-date with every single dollar you make or spend than with the live notifications that Tallyman Axis offers. You will always get that financial alarm when something has gone right or wrong or something has been initiated.

- Easily Accessible Financial Reports: You have the ability to get complete financial reports on various aspects like cash inflow/outflow, budgets, and financial statements in no time. With these reports, for sure, you will be equipped to make business decisions with conviction.

- Your Financial Management at Your Convenience: The Tallyman Axis mobile app is your one-stop solution for financial management no matter where you are and whenever you want to use it. It is designed to make banking on the go a breeze and is available on smartphones hence Tallyman Axis banking services can be executed from any location.